Intro to Bookkeeping (US) Study Notes, Review Questions and Classroom Discussion Topics Large Print Edition: for students with low vision

by ExamREVIEW- List Price: $20.95

- ISBN-10: 1484138384

- ISBN-13: 9781484138380

- Edition: Large type / Large print

- Type: Paperback

- Publisher: CreateSpace Independent Publishing Platform

About The Book

Information presented in class often contains the core concepts of the course. Yet, students frequently fail to master the skills of classroom... Read more

Related Books

- Year: 2011

- Edition: 1st

- Publisher: SAGE Publications Ltd

- Type: Paperback

- ISBN13: 9781849201902

- ISBN: 1849201900

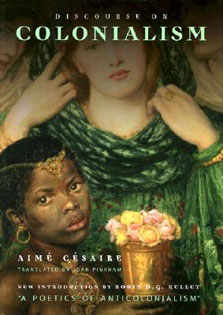

- Year: -0001

- Edition: Reprint

- Publisher: Penguin Books

- Type: Paperback

- ISBN13: 9780143120544

- ISBN: 0143120549

- Year: 2002

- Edition: 1st

- Publisher: SAGE Publications, Inc

- Type: Paperback

- ISBN13: 9780761987369

- ISBN: 0761987363